You can now download the SBI RTGS Form pdf/download SBI NEFT Form PDF to transfer funds in India. The SBI RTGS form and SBI NEFT form are used to transfer money from a bank account o another bank account. SBI RTGS form transfers more than two lakh rupees, and the NEFT form is for less than two lakhs to any bank account. If you want to do transactions through the State Bank RTGS and State Bank NEFT, you must fill the RTGS / NEFT form. When transferring funds from a State bank to any place in the country, one must download the State bank RTGS form or SBI NEFT form. You can read the information related to the State bank RTGS form or SBI NEFT form in this article. The sbi RTGS form download & SBI NEFT Form download process is easy. You can download SBI RTGS form pdf 2024 on mobile.

| Article | RTGC/NEFT PDF Form |

| Bank | SBI |

| Beneficiary | Bank Customer |

| Language | English |

| Official Website | Click Here |

For downloading RTGS and NEFT form immediately, you can look for State Bank RTGS / NEFT Form PDF 2024 Download, State Bank of India NEFT Challan Form, RTGS form SBI State Bank of India RTGS / NEFT Challan Softcopy, State Bank of India RTGS / NEFT Pdf Download, Application for RTGS Remittance of State Bank of India / challan pdf.

Bank offers RTGS & NEFT, enabling an effective, stable, reasonable, and reliable system for transferring funds from one bank to another and from a remitter’s account in a bank to a recipient’s account in another bank nationwide. Use the direct download link online for SBI RTGS form download PDF for free.

SBI rtgs form" width="478" height="230" />

SBI rtgs form" width="478" height="230" />

is a common platform offered by various banks in India. Customers in their comfort zone can access services without going to the bank. Online banking services, such as RTGS, are provided by banks as the easiest way to transfer money directly. The process is fast, simple, and secure; the bank provides a website portal to obtain online banking information without delays or waiting. Moreover, with the RTGS form SBI, one can easily make bank transactions of more than Rs. 2 lakhs.

SBI NEFT Form is another online payment system in which payment orders between banks are issued and processed at fixed times during the day on a deferred net settlement (DNS) basis. There is no minimum or maximum specified transaction value for using this service.

Any amount below Rs 20 Lakhs can be transferred with the SBI NEFT Form. And this method is usually for smaller value transactions concerning smaller amounts of money.

NEFT Sbi is an electronic fund transfer method; the transactions received up to a particular time are processed in assortments. Contrary to this, in RTGS Sbi, money transactions are processed continuously throughout the day on a transaction-by-transaction basis. RTGS is ground on the gross settlement, NEFT is based on net settlement. If the SBI RTGS form download PDF 2024 link does not work or if there’s any other trouble with it, try Reporting it by selecting an appropriate option such as broken link, copyright material or promotion content, etc. Alternate Links for downloading SBI RTGS/NEFT Application Form 2024 PDF are also available online.

Beneficiary account info:

*(You can find IFSC Code printed on cheque leaves.)

Online you can quickly download the SBI RTGS/NEFT form in PDF format.

For online transactions such as internet banking and mobile banking, NEFT transactions are available 24*7.

State Bank of India RTGS time is shown below:

| SBI RTGS Timing on Working weekdays Monday to Friday. | 7.00 AM to 6:00 PM. |

| SBI RTGS Timing on Working Saturdays | 7.00 AM to 6:00 PM. |

| SBI RTGS Timing on Sundays & Public Holidays | No Transaction Supported |

Follow the above table for RTGS timings SBI. If you have any issue with RTGS timings SBI you can call the SBI branch and enquire. In some areas, banks close before the time due to branch location and other factors.

State Bank of India NEFT time is shown below:

| SBI NEFT Timing On Working weekdays Monday to Friday | 7.00 AM to 7:00 PM. |

| SBI NEFT Timing On Working Saturdays | 7.00 AM to 7:00 PM |

| SBI NEFT Timing On Sundays & Public Holidays | No Transaction Supported |

State Bank NEFT is possible on all days of the year, including holidays. However, the bulk NEFT file should be uploaded before 19:00 for processing on the same day, and the bulk RTGS file should be uploaded before 17:30 for processing on the same day.

Keep in mind the following measures mentioned below when filling the SBI RTGS form or SBI NEFT form:

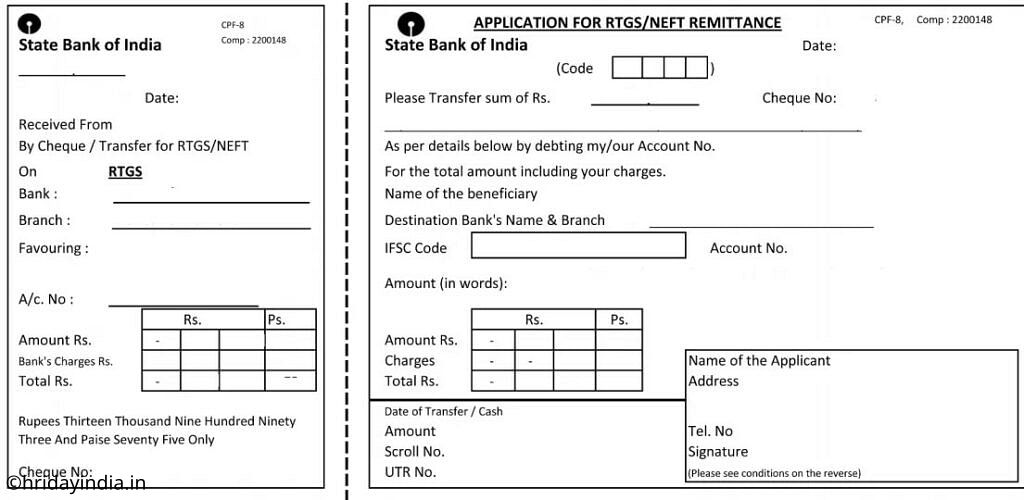

There are two parts to the SBI RTGS/NEFT form. The left section allows the customer to fill in all the details and enter the evidence documents. The right area is for the bank officials to verify the filled details, where the bank officials will mention transaction ID and other information.

SBI RTGS form requires entering the remitters’ account details. The details involve all beneficiary data and the correct IFSC code of the beneficiary bank branch. In addition, mention the amount to transfer, the date, and the remitter’s signature. Before submitting the RTGS form, ensure all information are accurate.

Next, you have to submit the form to the bank officer, and they will enter the details in the bank system.

In cases where the sum of the transaction is more than Rs. 2 lakh rupees, along with the RTGS SBI form, the applicant has to submit a cheque. In case of no chequebook or cheque available on time, the bank will arrange a temporary chequebook.

The RTGS method includes the remitters or the originating bank branch and the destination/beneficiary bank branches.

Note: The RTGS form SBI includes the beneficiary data like name, bank account, IFSC code, and account type.

There is no charge for NEFT and RTGS transactions; if RTGS and NEFT are done by the mobile application or through internet banking.

It’s a better option for internet banking; all transactions initiated through eBanking are free. Moreover, SBI imposes no additional charges for the sbi RTGS form & sbi NEFT form.

Here are the Charges for RTGS in the State Bank of India:

| Charges for RTGS transaction In SBI | SBI RTGS Charges (Exclusive of GST) |

|---|---|

| For Rs.2 lakhs to Rs.5 lakhs | Rs 20 |

| Above five lakhs rupees | Rs 40 |

Here are the Charges for NEFT form in the State Bank of India: